National Insurance threshold

Delivering his spring statement the Chancellor said that people would be able to earn 12570 a year. The lower earnings limit will rise by 3000 bringing it in line with the income tax threshold.

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

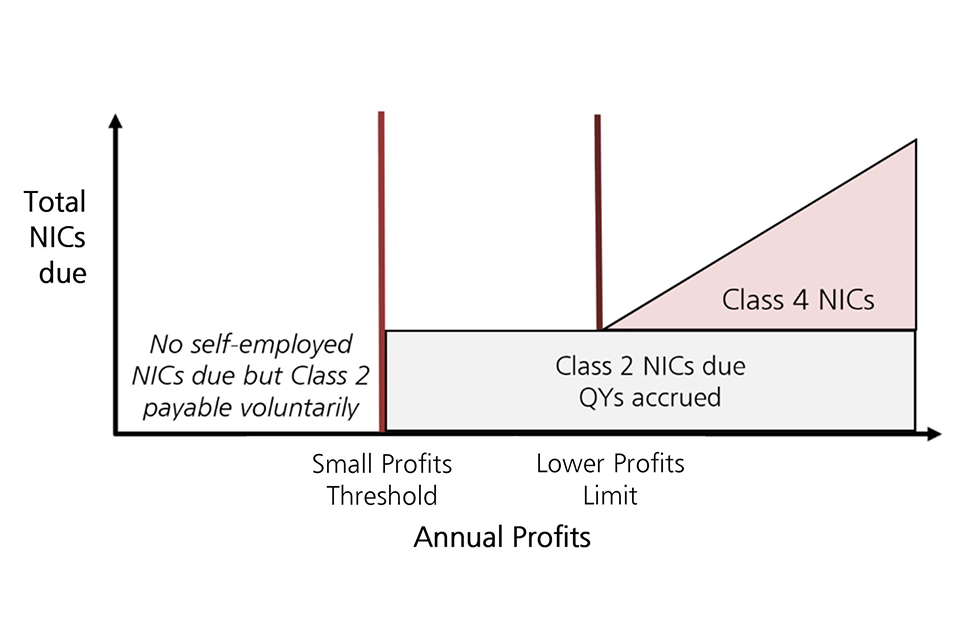

Draft legislation on National Insurance Contributions Increase of Thresholds This measure will increase the Primary Threshold PT for Class 1 NICs and Lower Profits Limit LPL for Class 4.

. Now the income threshold at which people have to start paying national insurance will go up by 3000. Rishi Sunak says the threshold for paying National Insurance will increase by 3000 this year. Mr Sunak also revealed a tax cut worth 1000 for half a million small businesses and the removal of VAT on energy efficiency measures such as solar panels heat pumps and insulation for five years.

This means that anyone who earns over 12570 will. People will keep an extra 3000 before they pay national insurance under the largest ever tax cut announced by Rishi Sunak. However this is based on out-of-date inflation figure.

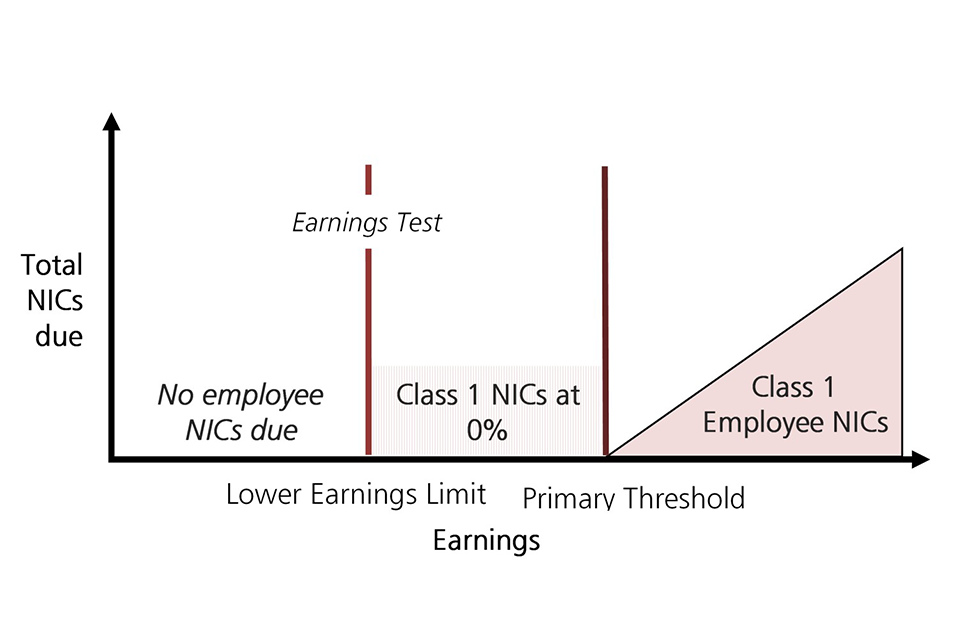

This means you will not pay NICs unless you earn more than 12570 up from 9880. Class 1 National Insurance thresholds You can only make National Insurance deductions on earnings above the lower earnings limit. Class 1 National Insurance rates Employee primary contribution.

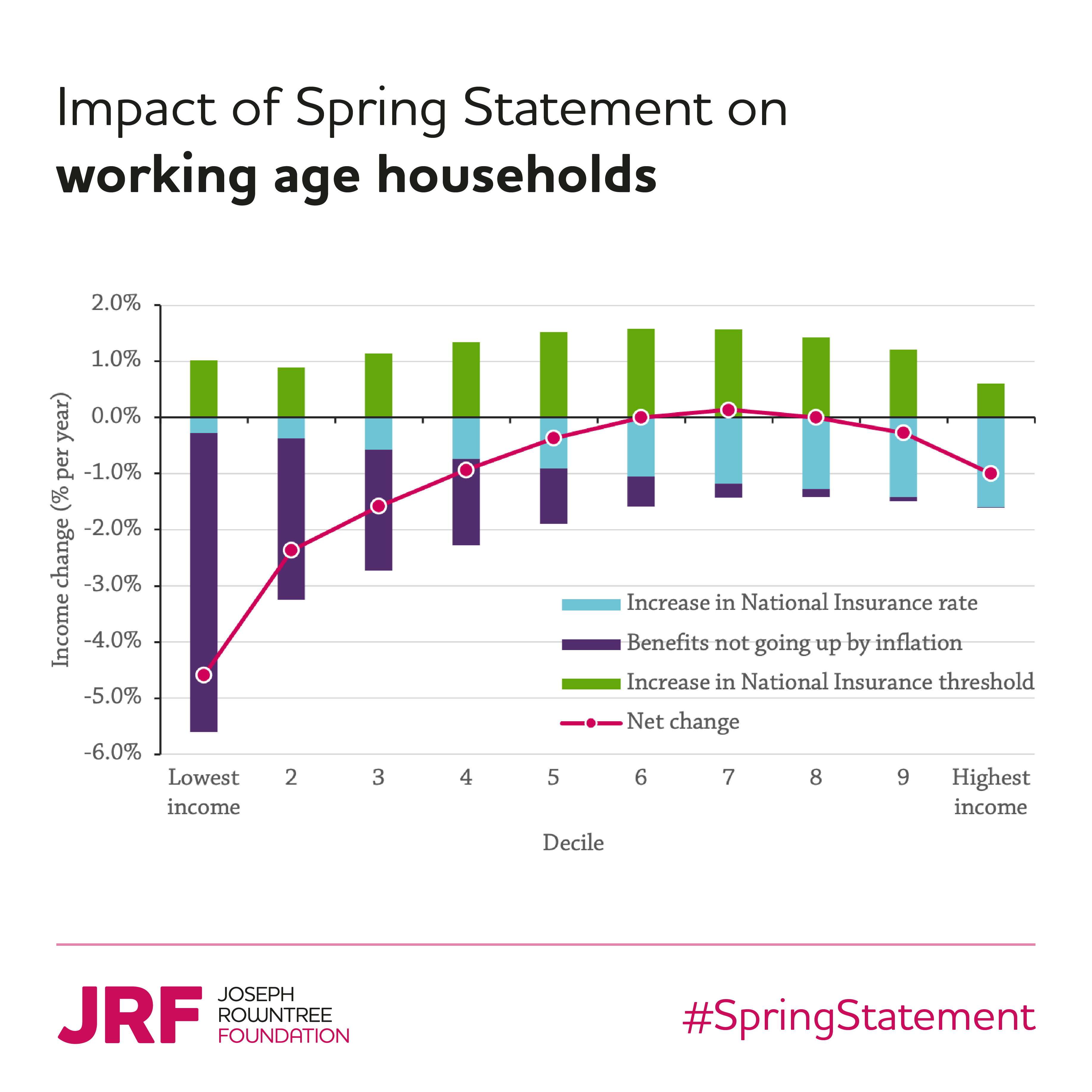

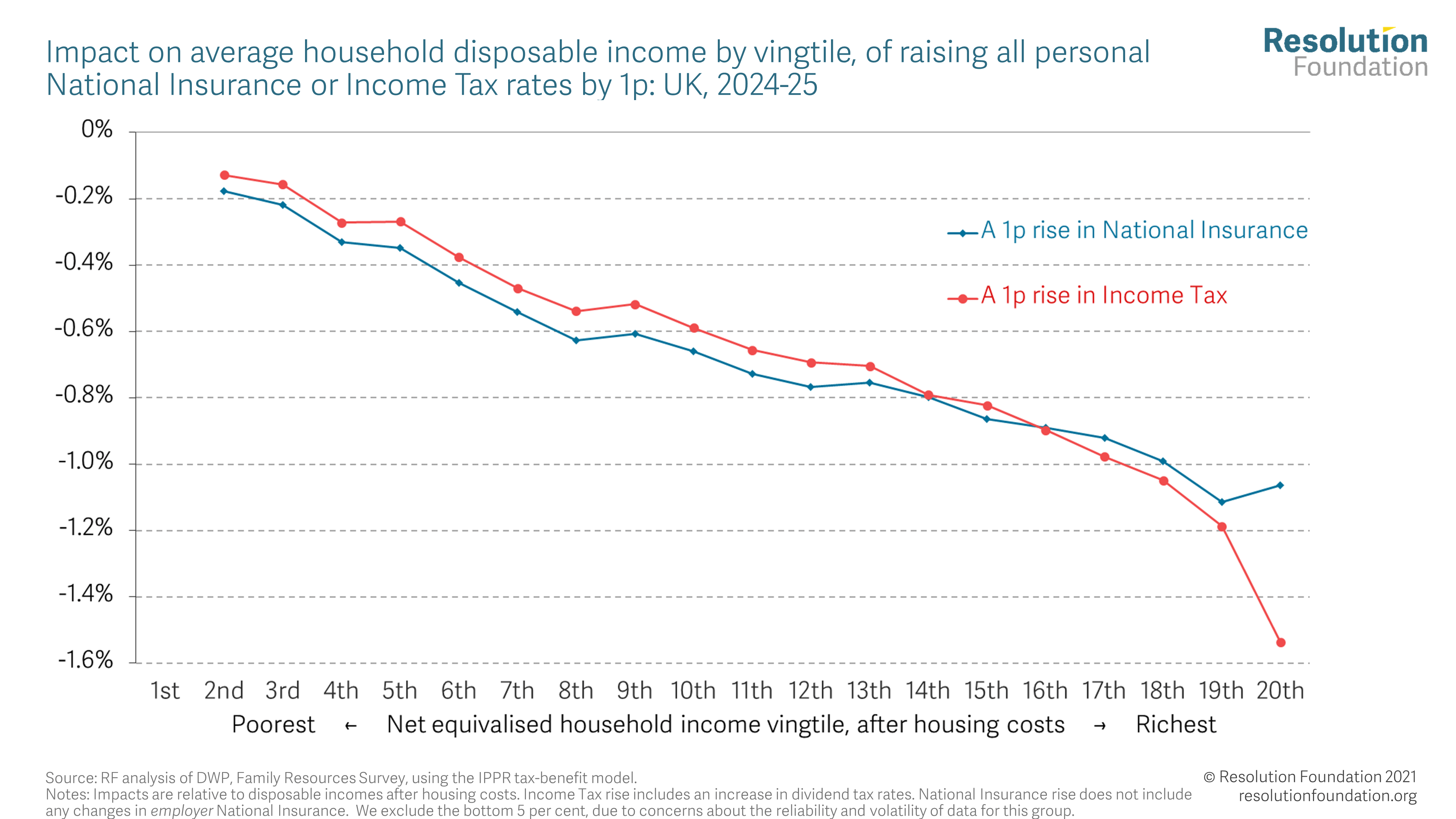

The annual National Insurance Primary Threshold and Lower Profits Limit for employees and the self-employed respectively will. This measure will increase the Primary Threshold PT for Class 1 National Insurance contributions NICs and Lower Profits Limit LPL for Class 4 NICs from 6 July 2022 aligning them with the. Changes to national insurance have been criticised as those on lower incomes will be dispropportionately affected.

Rishi Sunak has announced that the National Insurance Contributions starting threshold will rise by 3000 to 12570 from July meaning employees across the UK will keep more of what they earn. The National Insurance threshold is the level at which people begin to pay National Insurance. The national insurance change will bring the threshold to start paying the levy into line with that for income tax at 12570.

Chancellor Rishi Sunak has announced a National Insurance threshold rise and cut to income tax in his spring statement. Rishi Sunak has announced that he is raising the threshold at which people start paying National Insurance in an effort to help households cope amid the. If you earn less than this amount you wont have to make national insurance contributions.

However the chancellor did announce that the NI threshold would be raised. For 2021- 2022 the Class 1 national insurance threshold is 9568 a year. The Chancellor announced an increase in the National Insurance NI threshold for the 2022 to 2033 tax year and an increase in NI contributions.

The Government document outlining the full package today reads. The National Insurance threshold has been lifted by 3000 to equalise it with income tax the chancellor announced in the spring statement today March 23. The chancellor sparked a surprise by scrapping plans to increase the.

It will take some of the lowest earners out of paying. National Insurance rates will still increase by 125 percentage points for everybody from April which is equivalent to a 10pc jump for many. This means that UK workers will not have to pay any national insurance tax unless they earn above the new 12750 threshold which will come into effect from July 2022 in what Mr Sunak called the.

The threshold at which employees and. National insurance threshold jumps 3000 to 12570 from April National insurance contributions will rise 125 per cent in April. It means that workers will now start paying National Insurance on earnings above 12570 a year - up from a planned 9880 a year from April 6.

From July the salary at which employees will pay National Insurance contributions will increase by 3000 to 12575 which Sunak described as the largest single personal tax cut in decades and a tax cut that rewards work. The threshold at which you start paying is also set to increase to 9800. Rishi Sunak announced that the threshold at which you start paying National Insurance will change from July.

What is the National Insurance threshold.

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

National Insurance For Migrants Low Incomes Tax Reform Group

How To Read Your Payslip National Insurance Royal London

Nic Thresholds Rates Brightpay Documentation

Tax Year 2022 2023 Resources Payadvice Uk

Nic Thresholds Rates Brightpay Documentation

A Caring Tax Rise Resolution Foundation

Nic Thresholds Rates Brightpay Documentation

National Insurance What Is The National Insurance Threshold How Ni Is Calculated And Threshold Increase Explained The Scotsman